Contents:

The loss incurred by a negative theta is offset by the benefit received from a long option’s positive gamma. Conversely, the profit from a short option’s positive theta is offset by the negative gamma. Assume you own a call with a 0.40 delta; this means it will move 40% as much as the actual stock when put into action. It also implies that you get to trade 100 shares of the actual stock you are trading in for each share of your option contract. For example, if an options delta is 0.40, it implies the underlying stock moves 40% as much as it does.

It is critical to use the hourly chart in your technical analysis so that you may make knowledgeable judgments about when to start each position. This will help you achieve greater accuracy, minimize danger, and increase your chances of profit. When looking for short order entry conditions, scalping meaning in trading you will be searching for the exact opposite indicators as you were when placing long order entries. The 8-period EMA must drop below the 34-period EMA, and the price should fall below both. The central moving average is the line used to display the average movement of the market price.

Third, there are people who have a relatively short time horizon. Day traders are those who believe in buying and holding financial assets for just a day. Market making happens when a scalper tries to profit off the spread by simultaneously posting a bid and an offer price for a specific contract.

Forex scalping strategy

Quantity is the most essential aspect of the One-Minute method. It is not uncommon for traders to make more than 100 transactions each day to attain their desired daily revenue. Furthermore, the strategies shared here are extremely simple to grasp and can be mastered by anyone. When done correctly, scalping can increase your income and bring you closer to the financial freedom you deserve.

Scalping earnings may be increased by learning how to use this indicator. If you get good at it, you will consider it one of the most reliable indicators available if utilized appropriately. This part will explain what it is for and how to use it to maximize your profits. The MACD indicator is a straightforward one to understand and may be quite useful when scalping.

Connect With a Financial Advisor

This constant managing of risk is key to optimizing price moves while minimizing risk perpetually. Scalp trading is risk averse in that the trader wants to sit through as few wiggles as possible. If playing a long set-up, you are getting in quickly on the trigger and getting out even as the stock is rising to ensure plenty of liquidity for the exit and also potential commission rebates. Therefore, preparation must be made ahead of the trade to be fully aware of the triggers for entries and exits. When a market sees a protracted move in a given direction, a trend can be ascertained.

A self-confident newbie in scalping may turn into a loser if they does not have an algorithm for entering the market. Today, we will help you with this struggle and share some effective scalping strategies. Forex scalping can offer many opportunities because the market is active round the clock. However, the best forex scalping strategy is to concentrate on major currency pairs such as the EURUSD, GBPUSD, and USDJPY. These pairs have sufficient liquidity throughout and can be traded with very low spreads.

The key to becoming a successful crypto scalper is to enhance your chart reading skills and knowledge of different crypto trading strategies. At Liquid, we often discuss different trading strategies on our blog. Therefore, we recommend you stick to this space to learn more about different crypto trading strategies to find the most suitable one for you.

Spreads in Scalping vs. Normal Trading Strategy

And one of the best ways to do so is to start trading on demo first. Trading on demo will give you a good sense of the markets without risking your real funds, allowing you to learn and become a better trader and investor. In general, scalp trading can be aggressive and demanding and may be highly draining for untrained brains. Because the return from each trade is too small, more substantial capital is required to produce meaningful outcomes. Developing your ability to interpret charts and expanding your understanding of various crypto trading tactics are the keys to becoming a good crypto scalper. All things considered, we encourage you to get started with swing trading.

As you see the participants adjusting their bid and ask quotes, you can also place your orders directly to them or opt to provide liquidity or take liquidity. Direct order routing enables you to take complete control of your execution fills as well as collect ECN pass thru rebates applied to your commissions. Because of slippage and high volatility, trading around highly anticipated news reports can be very dangerous. You want your spreads to be as tight as possible since you will be entering the market frequently.

In a scalp trade, many positions of this type would be exited after just a couple of minutes, or even less than a minute, depending on the pips gained in the trade. While a position trade may last several months or even years, and a swing trade several days up to a few weeks, a scalp trade’s duration is mere minutes, or even seconds. A scalper wants that 2-pip loss to turn into a gain as fast as possible. In order to do this, the bid price needs to rise enough so it’s higher than the ask price that the trade initially entered at.

- By accurately analyzing the historical resistance and support levels of the asset in question, you can pre-determine the probable “range” the market will likely exhibit going forward.

- Second, scalping requires opening tens or even hundreds of trades per day.

- A direct market access brokers trading platform has all the aforementioned tools in addition to low-latency robust and stable data feeds and execution platform.

- Some scalpers like to trade in a more liquid market since they can move in and out of large positions easily without adverse market impact.

- Some of the major global indices that are ideal for scalping include the UK100, S&P 500, DAX, and DJIA.

This can be a particularly effective strategy in fast-moving markets, where prices may be fluctuating rapidly. Another approach is range scalping, which involves buying and selling stocks within a predetermined price range. Both scalp and swing trading are short-term investing strategies that rely on technical analysis and charts to profit from trends in particular assets. However, swing trading accompanies a more intermediate-term time frame, often a few days to a few weeks, focusing on acquiring fewer trades but with a larger profit target. A slower pace and a less stressful environment make swing trading more appropriate for novice and retail traders, while scalping is better suited to more seasoned traders.

It is suitable for all traders, from beginners to seasoned veterans. You must be capable of handling stress and performing under pressure – if you miss the very small window to close your position, you may be stuck taking a loss. Scalp trading strategy is not for everyone and requires an in-depth understanding of how the market operates. When you consider opening a short position, you need to sell when both slow and fast oscillators break below -70 and close when the fast one leaves the zone. Stop loss is placed several points above the resistance level nearby.

Read on to find out more about this strategy, the different types of scalping, and tips about how to use this style of trading. In our AUD/CAD chart, for example, we can use two EMAs to identify an impending upward trend, which may contain mini moves suitable for scalping. We offer over 330 currency pairs to trade on, which is the highest figure in the industry.

Summary: Scapling vs Day Trading, which is better?

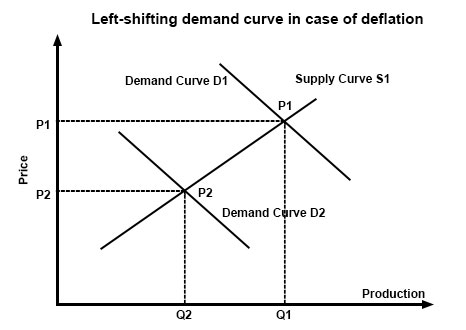

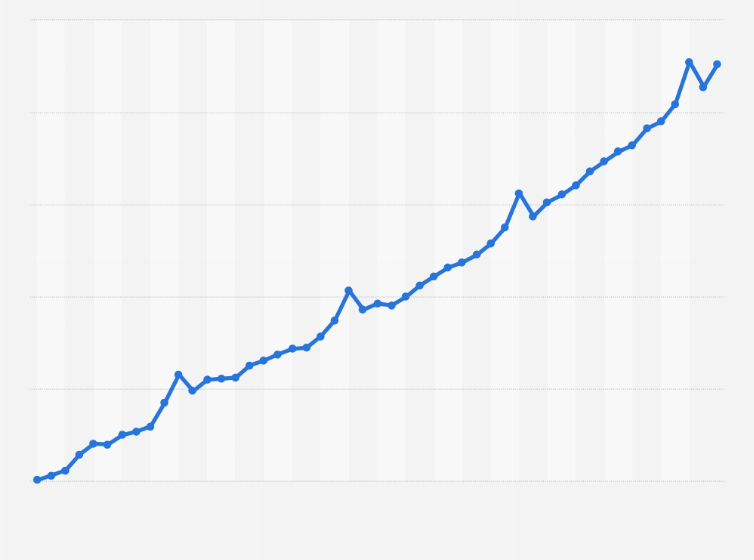

Its purpose is to compare the value of one particular nation’s currency to another. Inflation can have a big impact on the stock market, leaving unprepared investors in for a bumpy ride. In this article, we’ll explain why https://1investing.in/ inflation impacts the stock market and take a closer look at how the stock market has reacted to inflation in the past. While being able to observe the level 2 is important, it also helps to guide your order routing.

Best pair for scalping forex

They continually provide updates on short inventory throughout the day. Scalp trading forex is a way to trade currencies on the shortest timeframe charts. It’s a quick and potentially exciting way to trade – that comes with upsides but also with risks. Scalp trading, also known as scalping, is a popular trading strategy characterized by relatively short time periods between the opening and closing of a trade. Fundamental analysis is more suitable for long-term investing, while technical analysis works better for short-term strategies like scalping.

Scalping is a trading strategy that involves holding a position for a short period of time and selling it as soon as the market price changes in your favor. This is done in an attempt to make small profits that can add up over time. Scalpers typically trade with very tight stop-losses and take-profits, and they may enter and exit the market multiple times throughout the day.

Like day traders, forex scalpers will aim to never leave a position open overnight. But they’ll open and close trades at a much faster rate, meaning scalping requires even more discipline and focus than day trading. It’s the opposite of position trading, where you look to make large gains from a handful of long-term positions. Scalping is a trading strategygeared towards profiting from minor price changes in a stock’s price. Many small profits can easily compound into large gains if a strict exit strategy is used to prevent large losses.