Content

Generally speaking, they are the stocks of smaller companies that may have either fallen on hard times or are in their early stages of growth. The information floating around penny stocks in the market can be misleading and land an investor with shares of stocks that are worth nothing. Wild fluctuations in prices led by market participants is a common problem with penny stocks. Inaccurate information on the stocks performance and future prospects can also wreck one’s portfolio gains. Building a large corpus of a set of penny stocks isn’t enough and often an unwise decision.

- If you build a smart trading plan, you could ride CXAI’s highs while protecting yourself against its downside potential.

- These smaller, often early-stage companies typically have less public information compared to larger, more established companies.

- I had a nice chat with him about how he picks his penny stocks.

- This week D-Wave restated its stance in being ready to collaborate with the U.S. government to construct quantum computing applications in aiding public sector needs.

- That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators.

Regular monitoring allows you to react quickly to changes and make informed decisions based on the latest information. The point for traders is that this stock is in the midst of a technical breakout. I wouldn’t hold this stock for the next five years, but right now it’s looking pretty squeezy.

Top Penny Stocks for Q3 2023

Penny stocks belong to companies that are either very small or newly listed. Fidelity’s platform is secure and encrypted, ensuring the safety of users’ data and it does not charge any fee to start trading. It also offers excellent resources and tools for both investors and traders.

This offers an excellent opportunity for newbie investors looking to get a taste of the stock market without committing hefty sums. But how can we benefit from these opportunities, and how should we navigate the rollercoaster that is the stock market? The most exciting aspect of penny stocks is the potential for impressive returns.

Best Stocks For Beginners with Little Money: How To Trade Penny Stocks

It increased its hashrate capacity by 25% month-over-month, with self-mined bitcoin coming in at 347. This was an 8% jump over May and totaled 909 BTC minged during the second quarter. It announced a target to reach “zero packaging waste” by 2040. Many companies are working toward a more Environmental, Social & Governance (ESG) focus on appealing to specific groups of investors. To reach carbon neutrality, Grab reduced 48,000 tons of emissions in 2022. It also said that roughly 50% of its deliveries in Singapore are made via zero-emission modes of transport.

The company saw revenue of $224 million in the third quarter of 2022 and operating losses of $150 million. This article provides a comprehensive overview of the active penny stocks in 2023, cheap penny stocks, and the right platform to choose for penny stock trading. Investing in micro-cap stocks requires thorough research and caution due to their high risk profile. When evaluating these stocks, it’s essential to assess the company’s fundamentals – such as financial statements, revenue growth, profitability, and debt levels. Additionally, analysing the company’s macroeconomic landscape is crucial.

For investors interested in the 3D-printing space, AML3D ($AL3) is one to add to the watchlist. The company engages in contract manufacturing for customers including the U.S. Defence Force, Boeing ($BA), ExxonMobil ($XOM) and Chevron ($CVX), producing metal components and structures for their use. Having its IPO just three years ago, AML3D is still in its growth stage, focusing on patenting its technology and acquiring new customers. News catalysts usually come from companies that are frequently in the public eye.

Penny stocks face such long odds of success, so we need enormous winners to offset the hundreds of other duds. Hacking and the risk of technical failures are inherent risks that are also common in trading platforms. Its 52-week range falls between $1.26 and $7.05 with a beta trading volume of 1.11. The company’s stock performance of the last 1-year was -52.6% and YTD of 41.24%. This manufacturing firm saw sales grow by 88% to $130.5 million in 2022. However, the company was not profitable, with investors losing $0.38 per share.

B Riley analysts recently upped their $2 target to $3 while also keeping a Buy rating on the penny stock. As BTC prices have acted as a boon to crypto stocks, it has also done the opposite in times of downturn. Keep this in mind if WULF stock and other Bitcoin/crypto-related penny stocks are on your watch list. Thanks to heightened interest in cryptocurrency and rising Bitcoin prices, sector stocks have gotten a boost.

Is the money I use to trade on investment platforms insured?

Vaalco Energy is an oil and gas company with roots that trace back to 1984. The company operates 100% of its own assets, assets that span more than 230,000 acres. As Russia continues to invade Ukraine, gas prices are likely to continue to rise, making this a hot stock to watch. The other 86.8% of stocks (beyond BSE 500) are less traded. I thought that it will be nice if I can explain my understanding of ‘low-price penny stock‘ to my readers. In this list, he screens those stocks which have a low price (like below Rs.50).

- The sell side was expecting earnings of 2 cents per share.

- I’m not saying that Butler will be sold or restructured in the immediate future.

- Join Stake and access small cap securities along with 8,000+ other market opportunities across the ASX & Wall St.

- Even if you are less confident in an oil price rebound, you may still want to consider buying EGY stock.

- It relies on chart patterns that I’ve been trading for the past two decades — which still work in the dumb world of penny stocks.

This was a 254% jump compared to results from a similar period in 2021. However, the net loss for the company totaled $54 million. This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. You know that you don’t want to put all of your money into one stock — that’s a gambling maneuver, not a strategy.

Daily coverage of Stocks, ETFs, Indices, Forex, Commodities, Bonds & Cryptocurrencies. Oak Street Health, Inc, together with its subsidiaries, offers healthcare services to patients in the United States. The company operates primary care centers for Medicare beneficiaries. As of December 31, 2021, it operated 129 centers in 19 states, including Illinois, Michigan, Pennsylvania, Ohio, and Texas. The company was founded in 2012 and is headquartered in Chicago, Illinois.

Another Australian miner on this list, MinRex Resources ($MRR) holds interest in gold, silver and copper mining projects across Western Australia and New South Wales. Since its IPO in 2011, the company experienced https://g-markets.net/helpful-articles/bull-flag-chart-pattern/ wide fluctuations in share price until 2018 – from a low of $0.04 then to a high of $0.22. Currently, its share price is only a shell of its past, trending between $0.014 and $0.068 in the last year.

Costco and Home Depot Are Recession Winners — Which Is a Better Stock Buy?

It has deployed smart technology to help traders make informed decisions. If your trading strategy is a long-term one, make sure to regularly monitor your investments. This should be happening whether you’re trading penny stocks or blue-chip companies.

Since these types of stocks often come from smaller, less established companies, they may lack the transparency of their big-league counterparts. This can make it tricky to get reliable information to guide investment decisions. At the same time, the company has reduced debt on a quarter-on-quarter basis. Continued deleveraging is likely to translate into better credit metrics and DSX stock trending higher.

How did my friend screen the penny stocks?

If risk-taking comes roaring back in 2023, investors can expect Ginkgo Bioworks to trade in the $8-$10 range in short order. StocksToTrade in no way warrants the solvency, financial condition, or investment advisability ofany of the securities mentioned in communications or websites. In addition,StocksToTrade accepts no liability whatsoever for any direct or consequential loss arising from any useof this information. You can trade penny stocks on Robinhood as long as they are listed on a…

The company’s core holding is its shares of Banco Inter, a Brazilian digital bank that offers free banking services. In February, Inter & Co. announced that it acquired YellowFi, a fund manager and mortgage originator. This acquisition is expected to produce a meaningful increase in revenue and earnings ahead. The strong dividend makes this stock a hot pick for income investors. First, the firm has around $6.5 billion in long-term loans; its $770 million market capitalization is an equity stub on a mountain of debt. Second, a 2023 recession will almost certainly reduce sales by double digits.

#4 – Canopy Growth (NASDAQ:CGC)

Opendoor technologies is an American company operating a digital real estate platform for buying and selling homes and also covers insurance and escrow services. The top Reddit penny stocks in 2023 have the potential to do as well as the most famous Reddit penny stock of all —… Armed with the right information, a savvy trader can spot an opportunity that others might overlook. When you’re reading about penny stocks on your Reddit social media feed — or in any internet communities — keep your guard up.

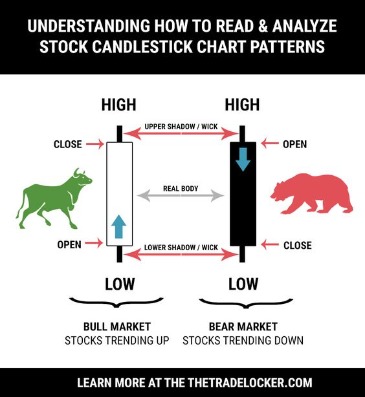

Everybody sees the gains that penny stocks are capable of — but they tend to ignore the collapses. The approach I teach my Trading Challenge students relies on reacting to what the market tells us, not predicting. It relies on chart patterns that I’ve been trading for the past two decades — which still work in the dumb world of penny stocks.