Content

We should note that these types of transactions often impact multiple periods until the transaction cycle is fully complete. An investor sold equipment with a book value of $700 for $1,000 to an investee as an arm’s-length transaction at the beginning of the year (a downstream transaction). The remaining life of the equipment is 10 years, and the investee does not intend to sell the equipment and plans to depreciate it on a straight-line basis for its remaining useful life.

What are two examples of equity accounts?

- Common stock.

- Preferred stock.

- Retained earnings.

- Contributed surplus.

- Additional paid-in capital.

- Treasury stock.

- Dividends.

- Other comprehensive income (OCI)

Terminal values are determined using two methods (1) applying a perpetual growth to dividends or free cash flows and (2) applying a multiple (P/E or EV/EBIDTA) on earnings or EBITDA. To reduce group-think biases, decisions to buy or sell are based on a super-majority 70% vote from class members. The equity method of accounting is used in private equity to pull profits and losses from lower–tier entities up to upper–tier entities.

What is the Equity Method?

An investor may sell part of its interest in a 100% owned foreign equity investment but maintain its significant influence. Consider the example of an initial investment of $1,000, and a sale price of $1,200 for 70% of investment. The investor has recorded $400 (credit) in retained earnings and $100 (credit) in CTA/OCI (due to FX translation) in its consolidated financial statements. Many https://www.bookstime.com/ equity investments do not require the complete acquisition of investees and their consolidations. Depending on circumstances, companies may account for an equity investment as consolidation, equity method, or fair value method. If an investor exercises neither control nor significant influence over the acquiree, the proper method of accounting for the investor is the fair value method.

Instead, they help a private equity firm visualize investment holdings, and allow governing agencies to monitor trading of private securities. The complexity of this business setup requires adherence to regulations and reporting procedures. The Securities and Exchange Commission (SEC) is a federal regulatory organization charged with safeguarding investors.

Catch-up To Private Equity Investments And Fund Accounting

Index linked bonds and loans are adjusted in accordance with the agreement. All other non-monetary assets must be restated unless they are already carried at NRV or market value. GAAP (which is fairly similar to that of the IASB), which incorporates the accounting standards issued by the United Kingdom Accounting Standards Board (ASB) and which, with some exemptions, applies to all registered companies. The value of any security is the present value of that security’s future cash flows. In these latter cases, the investments should be accounted for in accordance with IAS 39.

There are several ways a minority interest might be reported for tax reasons. For example, if Macy’s Inc. bought a portion of Saks Fifth Avenue, it stands to reason that Macy’s would be entitled to that same portion of Saks’ earnings. This raises the question of how Macy’s would report its share of Saks’s earnings on its income statement.

Need Accounting Help?

The investor records their initial investment in the second company’s stock as an asset at historical cost. Under the equity method, the investment’s value is periodically adjusted to reflect the changes in value due to the investor’s share in the company’s income or losses. The investor measures the initial value of an equity method investment at cost, recording the investment as an asset offset by the consideration exchanged. The value of the investment is increased by the investor’s proportionate share of the investee’s current period net income. On the other hand, the investment is decreased by the investor’s portion of the investee’s current period net loss, distributions, and dividends. The investment asset continues to be increased/decreased until the investment is disposed of or the investee’s portion of accumulated losses exceeds the investment balance.

- The term ‘at cost’ is not defined in IAS 28 and a discussion similar to that in IAS 27 applies here as well.

- This article wittingly avoided excessive details on some technical issues.

- Expenses recognized resulting from transactions (excluding transactions that are eliminated in consolidated or combined financial statements) with related party.

- Dividends are noted as revenue and are taxed as gains or losses on the initial purchase price.

You do not otherwise adjust the carrying value to reflect changes to the fair market value of the investee. FASB has issued guidance on dealing with equity method accounting for investments. This article expounds on the fundamental concepts of equity method accounting; its objective is to provide an accounting context and a general framework for equity method accounting.

Accounting Measures

In the case of fund accounting, clawback refers to the general partner relinquishing money that was previously paid out from an investment. This provision is made at inception and protects investors from mismanagement, poor performance, or liquidation. If any of these events come to fruition investors get to clawback all or a portion of their contributions. A hedged item can be a recognised asset or liability, an unrecognised firm commitment, an uncommitted but highly probable anticipated future transaction or a net investment in a foreign operation.

What is an example of equity?

Equity Example

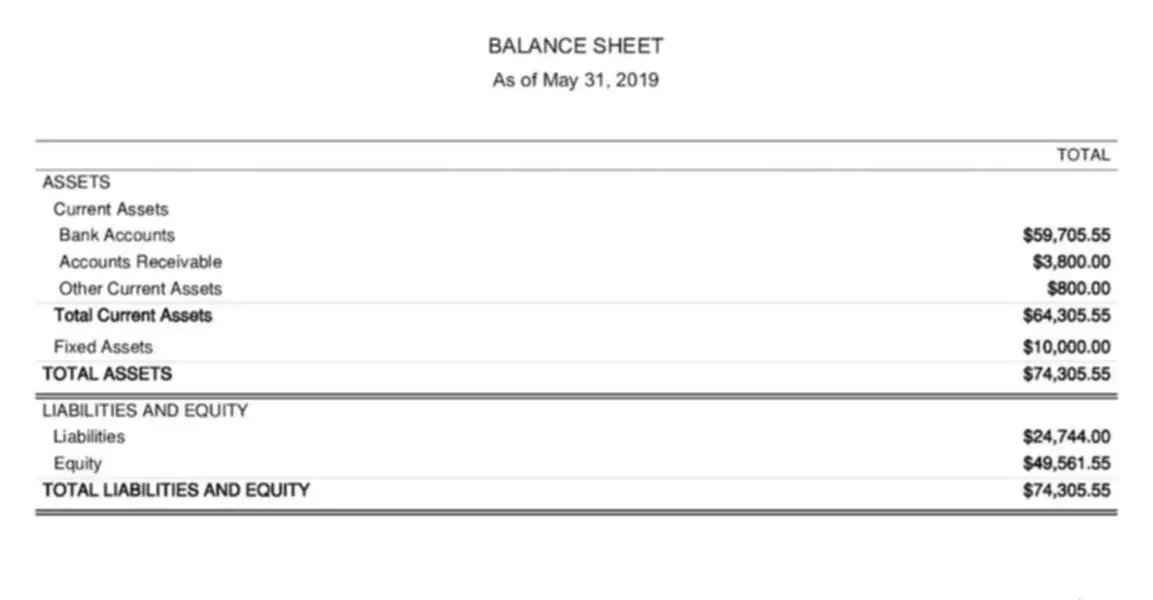

For example, if someone owns a house worth $400,000 and owes $300,000 on the mortgage, that means the owner has $100,000 in equity. For example, if a company's total book value of assets amount to $1,000,000 and total liabilities are $300,000 the shareholders' equity would be $700,000.

However, it can come up, especially if you’re in an industry or region where joint ventures and partnerships are common, or if you have more work experience. That’s a separate and more complicated topic, so we’re going to focus on just the equity method here. Zombie reports a net income of $100,000, which is reduced by the $50,000 dividend. Finally, Lion records the net income from Zombie as an increase to its Investment account. At the end of the year, Zombie Corp reports a net income of $100,000 and a dividend of $50,000 to its shareholders. There are downsides to both models because each favors one party over the other.

Alternative Methods

When reporting quarterly earnings the asset is revalued at current share price. The fair value method helps investors see the worth of their investment in real time. An investee that is accounted for under the equity method https://www.bookstime.com/articles/equity-method-of-accounting may report in the currency of a hyperinflationary economy. The balance sheet and income statement are restated in accordance with this standard in order to calculate the investor’s share of its net assets and results.