Contents:

Below is what a bullish divergence would look like in the graph. As we have discussed above, the same oscillates between zero and 100. You can see points 80 and 20 marked in the graph because they are deemed important in assessing overbought and oversold conditions. While there are many indicators that are in use to gauge overbought or oversold conditions, a relative strength index is one of the most used.

In our example, we will multiply the average absolute losses of 5 days and add today’s absolute loss and divide by 14. For calculating the next average gains, multiply the previous average gains by 13 and add today’s gains if any and divide the result by 14. In our previous example, we will multiply the average absolute gains of 9 days and add today’s absolute gain and divide the result by 14. Extreme value theory is a statistical theory that analyses extreme events that occur infrequently but have significant consequences. EVT is used in many fields, including finance, to model rare events that can profoundly impact asset prices and risk management.

Another plus point of RSI is that it could work in non-trending zones as well. This could work in favour of traders as most indicators work the best when the market is trending. RSI lines are used to gauge overbought and oversold readings in both bull market and bear market. Theoretically speaking, the level at which a stock enters the overbought territory is when it touches the 80-level mark on the RSI indicator.

Registered Office

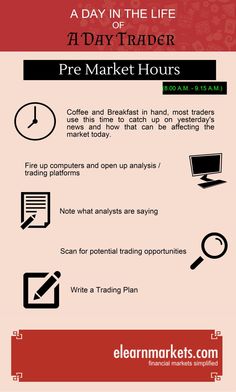

Her goal is to help readers make better investment decisions. But sometimes, you might come across situations where the RSI has started to diverge from the stock price. If you are long on a stock, then the oversold region is an indicator that you should be careful while buying the stock. That said, most new-age trading platforms have inbuilt services that display the RSI and RSI lines on your screen when you select the options. One such commonly used leading indicator is RSI or Relative Strength Index.

Chaos, on the other hand, can be harmful for relative strength investors since it can lead to sudden reversals of investing patterns, such as the financial crisis of 2007–2008. Investor psychology can shift in these situations, with yesterday’s investment darlings now being avoided. The utility of both indicators is another factor in relative strength vs RSI. The RSI is a momentum indicator which tells if security is oversold or overbought. For example, when the RSI is in the oversold territory and forms a higher low which matches with a corresponding low in the price of the stock, it is a signal of a bullish divergence.

Like for any other indicators, results of RSI indicator is most reliable when it conforms to long term trends. Actual reversal signs are rare and need to be filtered from false signals. An RSI value can show false positive when a stock price shows an overbought signal followed by a sharp decline.

https://1investing.in/, or Relative Strength Index, is a trading indicator used to determine overbought and oversold market conditions. It considers average gains and losses compared to prices from the previous periods and then produces an index between 0 and 100 from that calculation. The RSI value of 70 or above suggests that security or stock is moving toward the zone of being overbought and a pullback or a trend reversal is always on the cards. An RSI value of 30 or below shows that the stock is oversold and in undervalued condition. But if you trade based only on RSI, you are probably more destined to lose money. The RSI is effective when combined with moving averages, Bollinger’s Bands, or MACD .

How is RSI Calculated?

Please be aware of the risk’s involved in trading & seek independent advice, if necessary. Harshad – sell 60 min and daily entry on rsi crossover- For detail please mail on and share chartink.com with friends…….happy earning. Harshad -intraday sell on 5 min- For detail please mail on and share chartink.com with friends…….happy earning. Finally, you’ll learn step-by-step how to use RSI in conjunction with other indicators to build a complete trading system.

The RSI is a price-following oscillator that ranges between 0 and 100. Generally, technical analysts use 30 oversold and 70 overbought lines to generate the buy and sell signals. BSE Sensex is to be used for comparison, you will have to divide the current price of the security with the level of the Sensex. Another stock of the same sector or a sectoral index can also be used to derive the relative strength. In the case of relative strength comparison between peers, it is important to compare stocks that have a strong historical correlation. This article will discuss RSI or relative Strength Index, a widely used momentum oscillator for studying buy and sell signals in the price chart.

Source of Funding

For example, suppose a stock is trading at Rs 1,000 on Monday. On Tuesday it moves to Rs 1,050 and to Rs 1,100 on Wednesday. This indicates that the stock has ahigh momentumas it has moved upward by 10% in just 2 days. The concept of momentum oscillator is used to indicate the price velocity or the speed with which the changes in the prices of a stock are seen. This measurement of the momentum of the stock can be understood through an example.

GBP/JPY Price Analysis: Bulls to face 168.00, a price that capped previous rallies – FXStreet

GBP/JPY Price Analysis: Bulls to face 168.00, a price that capped previous rallies.

Posted: Thu, 27 Apr 2023 23:17:18 GMT [source]

Positive divergence is a situation where RSI makes higher high and higher lows, but price line registers a lower high and lower low. While studying RSI, divergence is what you should be looking for. RSI divergence indicates the point of inflexion, where the price line may change direction.

What is the meaning of the RSI indicator?

When we conducted a literature analysis of many papers, we found that similar types of studies had been conducted on the RSI subject. Various authors have addressed the use of RSI indicators on stock charts and conducted a comparative study. Additionally, the authors utilized other indicators within RSI and conducted a research study. RSI is a momentum indicator that provides insight into market trends.

If the RSI moves below 50, more traders are selling than buying and are driving the price down. The next step involves dividing the average gains by the average losses for getting the figure of Relative Strength. Volatility forecasting is a crucial aspect of quantitative finance, which involves using mathematical and statistical methods to make informed financial decisions. Volatility forecasting aims to estimate future market volatility, which measures the fluctuation in the price of financial assets. But overall, different studies have shown that RSI tends to give lesser false signals compared to MACD. At the same time, MACD is more versatile – it can be used to gauge trading signals in wider and more different timeframes.

Discover the Top Penny Stock Technical Indicators By Effectiveness – Penny Stocks

Discover the Top Penny Stock Technical Indicators By Effectiveness.

Posted: Fri, 28 Apr 2023 10:01:32 GMT [source]

It shows divergence with the price action inJubilant Foodworks. It indicates a trend reversal and the RSI indicator generates a sell signal. RSI being a leading indicator, can predict the price movements, corrections, pullbacks, and trend reversals ahead of several lagging indicators like MACD. RSI comes in handy while picking entry and exit points in traders and also in maintaining stop losses. Nonetheless, RSI must always be used in conjunction with other indicators when devising strategies for trade calls. If the RSI indicator is above 70, then the stock is considered to be overbought.

Finding overbought or oversold levels

If the 5 days EMA crosses below 20 days EMA when RSI is indicating overbought condition, it is a confirmation for a sell signal, even chance of possible trend reversal. Conversely, traders may buy the securities when 5 days EMA crosses above 20 days EMA with RSI signaling undersold. Higher trading volume at the time of crossover further strengthens the trading signal. To help investors/traders in dealing with a variety of circumstances, one should establish RSI parameters in advance to achieve your analytical goals for the situation. But we may utilize the RSI to detect overbought and oversold conditions for a limited period. Since the RSI rises, it is better at identifying wide market changes.

master the 5 cs of credit strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators.

Momentum indicator analyses how fast the share price changes. The formula for RSI is too complex for traders to manually implement it each time they plan to research a trade. To have a comprehensive knowledge of the concept, we have a simple formula that doesn’t ask for too many technical implications. Update your e-mail and phone number with your stock broker/depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge.

On the other hand, if the RSI indicator is below 30, then the stock is considered to be oversold. This analysis helps the traders, analysts, or investors to chart an investment strategy and take a buy or sell position for the stock. A pivot-based breakout indicator that attempts to provide traders with a visual aid for finding breakouts on the RSI. Similar to how we use trendlines on our charts, using them on the Relative Strength Index can also give us a sense of direction in the markets. This script uses its own pivot-based system that checks for real-time swing levels and triggers a new… Offering an understanding far beyond intuition, utilizing this information can be instrumental in forming a successful trading strategy.

EVT is beneficial for modelling tail risk, the risk of extreme events occurring beyond what is usually expected. Discover the importance of statistical inference in quantitative finance and its application to equities. Learn how it addresses challenges in financial data, including volatility and bias, to make accurate predictions and assessments.

RSI Indicator is the momentum oscillator that is used to identify the price trend reversal. The formula for calculating the RSI indicator is the difference between the average closing price on the up days and down days. The default period for analyzing the RSI indicator is 14 days. The CoffeeShopCrypto 3pl MA indicator is a technical analysis tool that uses three different moving averages to identify trends in the price of an asset.

Buying at overbought levels and selling at oversold levels is the traditional approach. We have seen that the traditional approach is full of whipsaws. It doesn’t work as accurately as it did when Wilder invented this indicator. The chart below the candlestick chart is the RSI indicator. If you carefully look at the chart, there are two levels 70 and 30.

What are the limitations of the RSI indicator?

After which, it breaks its most recent low and to march into bearish territory. The below pictorial representation may help you understand the same better. But RSI holds more information than what is seen on the surface level. It is often used with a combination of other indicators to form sound strategies. For ease of calculation, let us assume the stock has profitable closes in 7 days and unprofitable closes in 7 days out of the last 14 days.

Our baskets are low-cost which are designed to provide the best return at the least risk possible. RSI can be utilized using weeks or even months as inputs rather than days, hours, or minutes, despite the fact that traders typically use it on shorter time scales. It is feasible to match short-term transactions with long-term trends by adopting a longer time horizon. A daily RSI purchase signal is more likely to be successful if the monthly RSI is still fairly low and increasing.

- Increasing the setting makes the RSI less sensitive and results in fewer instances of the crude oil being identified as overbought or oversold.

- RSI can range between 0 to 100 and is displayed on a line graph generally placed below the stock chart.

- In a bullish trend, the RSI indicator usually shifts between the range of 40 to 80 or 90.

- A bearish divergenceoccurs when the indicator moves lower but the price of the security continues to rise.

Let us know about RSI in detail and see how you can form strategies around it. During an uptrend, the RSI tends to stay above 30 and usually hits 70. On the opposite case of a downtrend, RSI rarely exceeds or touches 70 and moves around the range of 30. This can be useful to spot trend strength and potential reversals. Conversely, if the RSI is unable to breach 30 marks in the charts and tests the support level multiple, it is signaled for a possible break of a downtrend and could be reversing to the upside. RSI trading strategy aims to generate buy and sell signals by the horizontal lines that appear on the chart at the 70 and 30 values.

Apurva has alsocreated a screenerfor you to identify these reversals. Moreover, he has also shared real life examples ofPSUbanks where he used this strategy to identify several winning opportunities in 2016 and 2020. We are certain that you won’t find such detailed and insightful video anywhere on the internet. Update your mobile numbers/email IDs with your stock brokers.